onurdongel

Introduction

Aemetis ( NASDAQ: AMTX ) is an international company that specializes in renewable natural gas and fuels. Their focus is on developing innovative products and technologies that have a negative carbon intensity, which can replace traditional petroleum-based products. The company’s main operations include California Ethanol, California Diary Renewable Natural Gas, and India Biodiesel. Their primary goal is to generate sustainable renewable fuel solutions, which will likely attract more attention and demand in the near future due to the growing biofuel and renewable industry. Aemetis achieves this by utilizing agricultural waste to produce low-carbon, advanced renewable fuels that reduce greenhouse gas emissions. In this assessment, I have analyzed the company’s financials in comparison with its peers and thus, I conclude that currently, AMTX is not an appropriate investment.

Aemetis business and financials

Aemetis has implemented various energy efficiency initiatives , including the installation of high-efficiency heat exchangers, the Mitsubishi ZEBREXTM ethanol dehydration system, a two-megawatt solar microgrid with battery storage, the Allen Bradley Decision Control System [DCS] for managing and optimizing energy usage and other plant operations, and the Mechanical Vapor Recompression [MVR] system for steam reuse. These projects aim to reduce petroleum and natural gas consumption by shifting processes to electricity and utilizing low-carbon-intensity hydroelectricity or onsite solar power. As a result, by lowering the carbon intensity of ethanol production, Aemetis can increase the price of their ethanol output.

The company employs advanced technology to generate renewable hydrogen from agricultural biomass waste, specifically orchard waste wood in California’s Central Valley, for the production of SAF and diesel fuel. Their plan involves utilizing the abundant 1.6 million tons of annual waste orchard wood in Central California, as well as other waste wood feedstocks. Upon completion of these constructions, the company’s revenue and cash flows are expected to increase. Unfortunately, in early 2023, Aemetis was forced to halt operations at their Keyes plant due to a 500% increase in energy costs. This was attributed to an inadequate natural gas storage in the Western United States, making their ethanol business unprofitable. As a result, their revenue plummeted to $2.2 million by the end of 1Q 2023 year over year compared to $52 million during the same period in 2022. However, with natural gas prices currently at reasonable levels, they plan to resume operations at the Keyes ethanol plant in Q2 2023.

In addition, Aemetis management implemented several essential energy efficiency enhancements at the Keyes ethanol plant. These included the installation of a cutting-edge control system with artificial intelligence capabilities, which will enable the facility to operate using high-efficiency electric motors and pumps powered by low or zero-carbon renewable energy sources. The company also installed a solar microgrid and sourced other local renewable electricity options. Upon completion of these efficiency projects by the end of 2024, natural gas consumption at the Keyes plant will be reduced by over 80%, resulting in significant cost savings for the company.

Furthermore, Aemetis has recently obtained approval from the U.S. EPA for its Biogas Services subsidiary’s RNG production facility to generate D3 RINs under the federal Renewable Fuel Standard. This achievement has enabled Aemetis to operate seven fully functional dairy biogas digesters since June 2023. The renewable natural gas produced by Aemetis is expected to generate multiple revenue streams, including the sale of RNG as a replacement for petroleum diesel in transportation, the sale of California Low Carbon Fuel Standard credits used by fuel blenders to meet carbon reduction and pollution offset mandates in California, the sale of RINs generated under the federal RFS, and the sale of Inflation Reduction Act production tax credits starting in 2025.

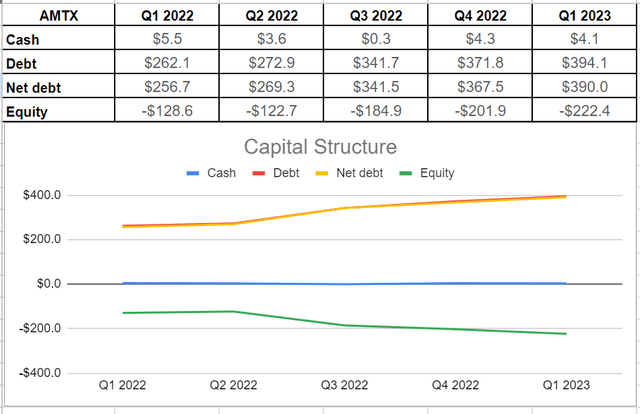

On the other hand, Aemetis financials bring concern. Aemetis recorded a cash balance of approximately $4 million in the first quarter, which was 25% lower compared to the same period in 2022 when it was $5.5 million. However, their net debt increased significantly from $262 million in 1Q 2022 to $390 million in the recent quarter. Furthermore, their current liabilities as of March 31, 2023 amounted to around $261.8 million, which is significantly higher than the $88.2 million recorded in the comparable quarter of 2022. Given these figures, there are concerns about Aemetis’ ability to pay off its short-term liabilities. Although high leverage is common in the utility industry to some extent, with total assets worth $210.3 million and negative levels of equity over the past year, Aemetis’ debt level could become a major issue that needs addressing (see Figure 1).

Figure 1 – AMTX’s capital structure (in millions)

Author

Aemetis stock valuation

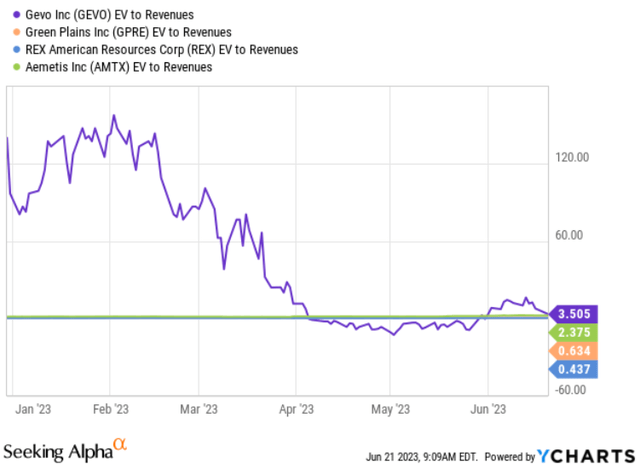

Aemetis reported an Adjusted EBITDA of $(7.583) million at the end of the first quarter of 2023, compared to $(6.998) million in the same period in 2022. The company’s net loss for the recent quarter was over $26.4 million, up from $18 million in 1Q 2022. Among its peers, REX American Resources ( REX ) has the most straightforward financials, with an EV-to-EBITDA ratio of 9.55 in TTM. Also, in terms of EV-to-Revenues as another valuation metric, we can see that AMTX has one of the highest amounts versus its peers. the EV-to-Revenues of AMTX is 2.37x, which is higher than the peers’ average of 1.73x. Similarly, REX has the lowest amount of 0.43x (see Figure 2).

Figure 2 – AMTX’s financials vs. its peers

YCharts

Conclusion

As a renewable industry company, it is normal to bear high levels of debt to some extent. However, AMTX’s large amount of debt has become a major threat to the company. At the end of the first quarter of 2023, they faced $395 million of debt, which is far higher than their total assets of approximately $210 million. Notwithstanding promising news regarding their RNG facility that received EPA approval for D3 RIN generation, I believe the management is required to improve its capital structure before being able to generate profit for its shareholders. Thus, I conclude that a hold rating would be appropriate for Aemetis.

As always, I welcome your opinions.