NORTHAMPTON, Mass. (WWLP) – After an over three-year pause brought on by the pandemic, federal student loan payments will resume this fall.

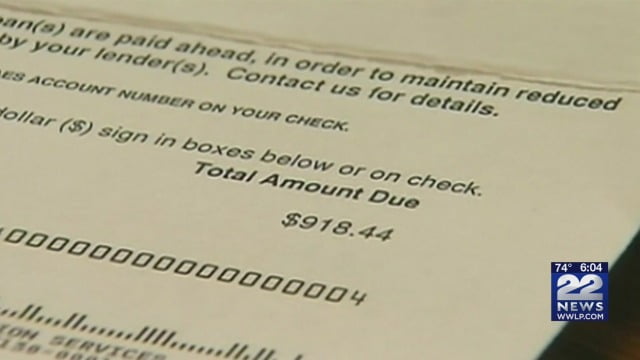

As a result of the debt-ceiling deal, student loan payments resume in October, with interest starting in September. The end of this payment moratorium, a financial storm looming for countless borrowers.

Danielle Amodeo of Northampton, told 22News, “I don’t think anyone should be in crippling debt because they tried to get an education,” but that’s the reality millions of Americans are facing.

Right now, more than 1 in 13 student loan borrowers is behind on their bills, which marks an increase from before the pandemic. There are preparations that can be made now, though to lighten the financial burden. Martin Lynch of Cambridge Credit Counseling urges borrowers to take advantage of the income-driven repayment option, which sets your plan in accordance with what you make.

Lynch said, “It’s an opportunity for people who work in the non-profit world to get their loan balances forgiven after ten years of repayment and for for-profit workers to get their balances forgiven after 20 years of repayment.”

There’s a loan-simulator tool available on the Federal Student loan website, that allows borrowers to figure out which payment plan makes the most sense for their budget. It’s also recommended to begin communicating with your loan servicer now…and get in touch with a financial advisor for guidance.

Repayment programs will not be affected by the supreme court ruling on Biden’s $400 billion student loan forgiveness plan, that decision is expected by the end of this month.

Latest News

Kaelee Collins is a reporter who has been a part of the 22News team since 2022. Follow Kaelee on Twitter @kaelee_collins and view her bio to see more of her work.